BACKGROUND AND PURPOSE

Historically, Section 5 of the FTC Act has been the primary source for guidance of unfair or deceptive acts or practices (UDAP). However, under the Dodd-Frank Act, the Consumer Financial Protection Bureau (CFPB) was granted rule-making authority to prevent unfair, deceptive, or abusive acts or practices in connection with any transaction with a consumer for a consumer financial product or service, or the offering of a consumer financial product or service. Accordingly, it is unlawful for any provider of consumer financial products or services or a service provider to engage in any unfair, deceptive or abusive act or practice. The banking regulatory agencies have the authority to enforce UDAAP.

SCOPE

This Unfair, Deceptive, Abusive Act and Practices Policy applies to all employees, contractors, and third-party vendors of FACEBANK. It safeguards consumers from unethical or misleading tactics by financial products or service providers.

KEY PROVISIONS

Unfair Acts or Practices

An act or practice is unfair where it:

- Causes or is likely to cause substantial injury to consumers

- Cannot be reasonably avoided by consumers

- Is not outweighed by countervailing benefits to consumers or to competition.

To be classified as unfair, an act or practice must cause or be likely to cause substantial injury to consumers. Often, the substantial harm occurs in the form of monetary harm. Banks should monitor fees, interest, and other similar costs to ensure that they are not deemed unfair. Substantial harm may also result when small amounts of negative impact affect a large number of consumers. The agencies have stated that, in most cases, emotional harm will not ordinarily make the action unfair.

A practice is not considered unfair if consumers may reasonably avoid injury. However, consumers cannot reasonably avoid injury from an act or practice if it interferes with their ability to effectively make decisions. Therefore, banks must be careful to disclose all material information when conducting a transaction with consumers. Additionally, banks may not engage in any coercive action to complete consumer transactions.

Typically, the agencies will not find an act or practice unfair solely on the grounds that a consumer could have obtained a more appropriate or satisfactory product or service elsewhere. One way for banks to manage this risk is to review all promotional material and disclosure statements to ensure that all the terms of each product or service are fairly and adequately disclosed

Banks cannot escape the regulations by providing significant benefits, such as lower rates or fees, in order to mask the injurious act or practice. The agencies have stated that injuries must not be outweighed by any offsetting consumer or competitive benefits that are also produced by the same act or practice.

While public policy considerations themselves will not be used as the primary basis for declaring an act or practice unfair, they will be considered by the agencies. The fact that a particular practice violates a state law, or a banking regulation may be considered as evidence in determining whether the act or practice is unfair. Alternatively, the fact that a particular practice is affirmatively allowed by statute may be considered as evidence that the practice is not unfair.

The result is that banks must participate in a comprehensive approach when determining whether to retain or implement products and services. All facets of the products and services should be analyzed to make certain that they will not be unfair.

Deceptive Acts or Practices

The agencies use a three-part test to determine whether a representation, omission, or practice is deceptive:

- The representation, omission, or practice must mislead or be likely to mislead the consumer.

- The consumer’s interpretation of the representation, omission, or practice must be reasonable under the circumstances.

- The misleading representation, omission, or practice must be material.

Deceptive representations, omissions, and practices occur in many ways. Express or implied promises and oral or written omissions may all lead to a deceptive situation. An individual statement, representation, or omission is not evaluated in isolation. Instead, the agencies will evaluate it in the context of the entire advertisement, transaction, or course of dealing to determine whether it constitutes deception.

The agencies place a great importance on the reasonableness factor. The test is whether the consumer’s expectations or interpretations are reasonable in light of the claims made. When representations, omissions, or practices are targeted to a specific audience, such as the elderly or the financially unsophisticated, the standard is based on the effects of the act or practice on a reasonable member of that group.

A representation, omission, or practice is material if it is likely to affect a consumer’s decision regarding a product or service. Information about costs, benefits, or restrictions on the use or

availability of a product or service is generally a material element. Express claims, made with respect to a financial product or service, are presumed to be material. Similarly, claims made with the knowledge that they are false will also be presumed to be material.

Abusive Acts or Practices

The Dodd-Frank Act makes it unlawful for any covered person or service provider to engage in an “abusive act or practice. “An abusive act or practice:

- Materially interferes with the ability of a consumer to understand a term or condition of a consumer financial product or service or

- Takes unreasonable advantage of:

– A lack of understanding on the part of the consumer of the material risks, costs, or conditions of the product or service;

– The inability of the consumer to protect its interests in selecting or using a consumer financial product or service; or

– The reasonable reliance by the consumer on a covered person to act in the interests of the consumer.

Although abusive acts also may be unfair or deceptive, examiners should be aware that the legal standards for abusive, unfair, and deceptive each are separate.

MANAGING RISK

While the majority of banks adhere to a high level of professional conduct, banks are reminded that they must take a proactive approach to identifying and stopping any acts or practices that may be seen as unfair or deceptive. There are numerous ways a bank may prevent violations of the unfair or deceptive acts or practices regulations. Banks should draw consumers’ attentions to the key terms, limitations, and conditions of each product or service so that the consumer can make informed decisions. Additionally, advertisements should be tailored for a realistic bank audience. Banks should also ensure that third parties who market or promote the bank’s products or services are adequately trained to make clear and accurate statements and representations.

RECORD RETENTION

All regulations require that a creditor maintain records as evidence of their compliance. The Bank will maintain records on all complaints for a minimum of five (5) years in order to maintain compliance with all applicable regulations.

FACEBANK POLICY

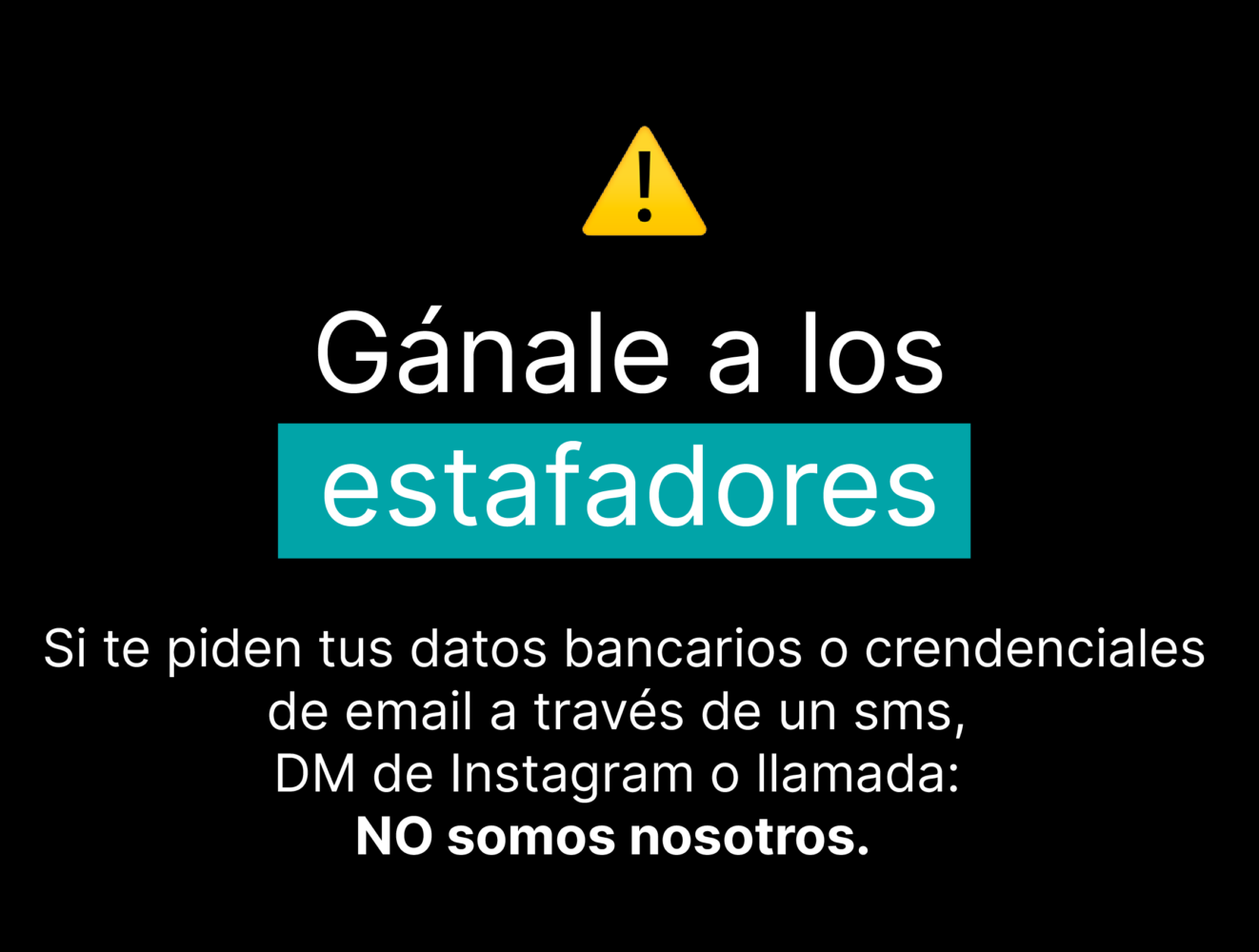

The Bank has established that in no such manner would the Bank violate customer’s rights under the UDAAP regulation. FACEBANK employees are committed to ensure that no such deposit/lending products or services offered to the customer create any injury.

The Risk and Regulatory Compliance Department will review all consumer complaints and determine if there are potential UDAAP concerns. If potential UDAAP concerns exist, this matter will be discussed with the appropriate department to determine an action plan.

In addition, the Risk and Regulatory Compliance Department will provide appropriate training to all Bank employees regarding UDAAP at least annually in order to mitigate the risk of any consumer complaints related to the Act.

AMENDMENTS

The Unfair, Deceptive, Abusive Acts or Practices Policy will be updated to ensure FACEBANK compliance with regulatory requirements as regulations evolve.

Escanea el código QR con tu celular y descarga «Tu Cuenta Dólar FACEBANK». Completa tu solicitud en minutos, te responderemos lo antes posible *

Escanea el código QR con tu celular y descarga «Tu Cuenta Dólar FACEBANK». Completa tu solicitud en minutos, te responderemos lo antes posible *