With SecurLock you have the ability to protect your cards

Keep your cards protected by setting usage parameters and receive instant notifications every time they are used.

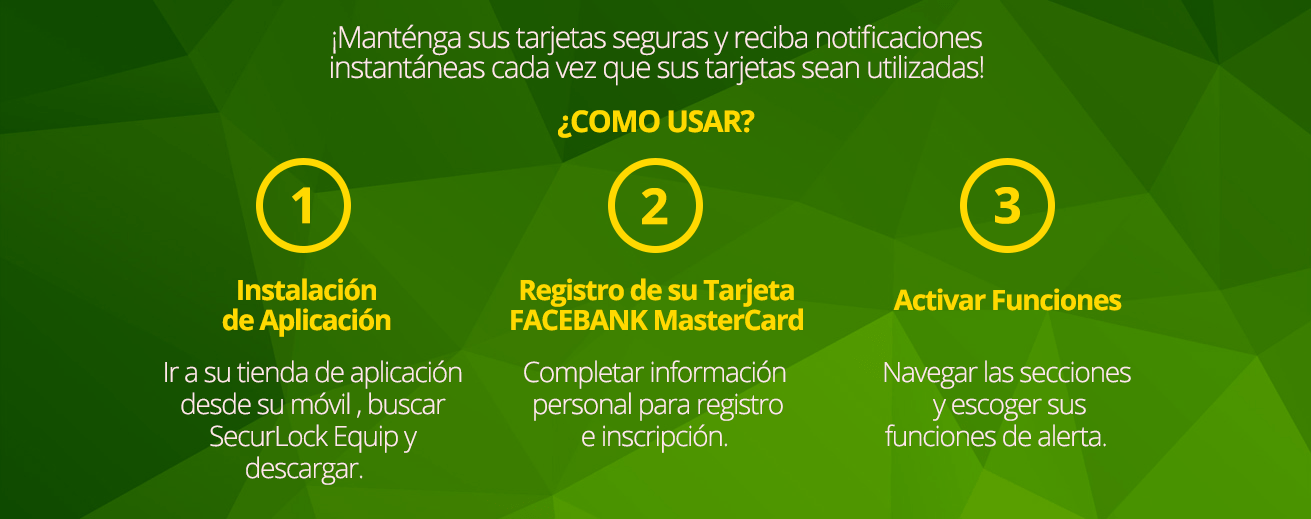

Mantenga sus tarjetas de Facebank seguras y reciba notificaciones instantáneas cada vez que sus tarjetas sean utilizadas.

¿Cómo Usar La Aplicación?

Benefits

Upon installation and set up with SecurLock you will be able to

FAQs

SecureLock is a mobile app which grants the user the ability to control how, when and where your debit cards can be used. It is the easiest and secure way to monitor your cards’ transactions.

To use SecureLock you must have an active FACEBANK credit or debit card and a smartphone (Android or iOS). Once you have downloaded the app, you must enter your card number and personal information to complete the registration process.

Son compatibles dispositivos Android – versión 4.1 o posterior y Apple (iOS) – modelo de dispositivo 4S, 5, 5C, 5S, 6 o 6 Plus con la versión 6, 7 u 8 del sistema operativo iOS y todos los dispositivos / lanzamientos futuros.

Después de descargar la aplicación, debes ingresar tu número de tarjeta completo e información de autenticación. Una vez registrado, puedes comenzar a usar la aplicación.

Click here if you have an iPhone to download the app. Apple.

Click here if you have an Android device to download the app. Google Play store.

The app is completely free with no hidden fees.

As many FACEBANK cards as you want.

It is required to provide your email address in case you need to reset your password or if you forgot your username.

Puede comenzar a utilizar el servicio inmediatamente. Al girar el pequeño botón verde en la esquina superior derecha de la imagen de la tarjeta se convertirá en rojo. Esto significa que se rechazarán todas las transacciones (excepto transacciones recurrentes). Cuando esté listo(a) para hacer una compra simplemente enciende el botón nuevamente. Es así de fácil. Usted activará y desactivará su tarjeta según su conveniencia y necesidad.

Inicia selectivamente los controles y alertas por canal (en la tienda, en línea, móvil, ATM, etc.). También puedes establecer límites de gastos de transacción, seleccionar ubicaciones geográficas, en donde se puede utilizar la tarjeta, establecer categorías de comerciante específicas, ver historial de transacciones recientes, recibir alertas en tiempo real y mucho más.

Es ideal para el control de tarjetas corporativas, estudiantes universitarios y usuarios particulares!

It is a notification sent to your phone every time you use any of your registered cards. You may choose to receive a notification for every transaction, payment reminders or preferred transactions. The alerts can be set up using the SecurLock’s notification preferences within the app.

Changes will become effective Immediately after changing your settings. Remember to save every time you make changes!

To log out just press the three-lined icon on the top right of the application and press log out.

The SecureLock requires a password to access the app. Additionally, no sensitive information is stored in your phone. It only saves the last 4 digits of your cards.

Yes, you should still notify FACEBANK prior to any trips to avoid any inconvenience. SecureLock does not replace the process. To notify us of any future travels, call us using any of the numbers listed at the bottom of the page.

Escanea el código QR con tu celular y descarga «Tu Cuenta Dólar FACEBANK». Completa tu solicitud en minutos, te responderemos lo antes posible *

Escanea el código QR con tu celular y descarga «Tu Cuenta Dólar FACEBANK». Completa tu solicitud en minutos, te responderemos lo antes posible *